Roth vs. Traditional IRA/401(k): Choosing the Right Retirement Account for Your 20s & 30s

Roth vs. Traditional IRA/401(k): Choosing the Right Retirement Account for Your 20s & 30s

Starting to save for retirement in your 20s and 30s is one of the smartest financial moves you can make (hello, compound interest!). But once you decide to save, you'll likely face a choice: Roth or Traditional? This applies to both Individual Retirement Arrangements (IRAs) you open yourself and employer-sponsored plans like 401(k)s or 403(b)s.

Choosing the right type can mean a difference of tens or even hundreds of thousands of dollars come retirement, mainly due to taxes. Let's break down the key differences.

Quick Distinction: IRA vs. 401(k)

- IRA (Individual Retirement Arrangement): An account you open and fund yourself.

- 401(k) / 403(b): Employer-sponsored plans you contribute to via payroll deductions. Often come with a valuable employer match (free money!).

Both types typically offer Roth and Traditional versions.

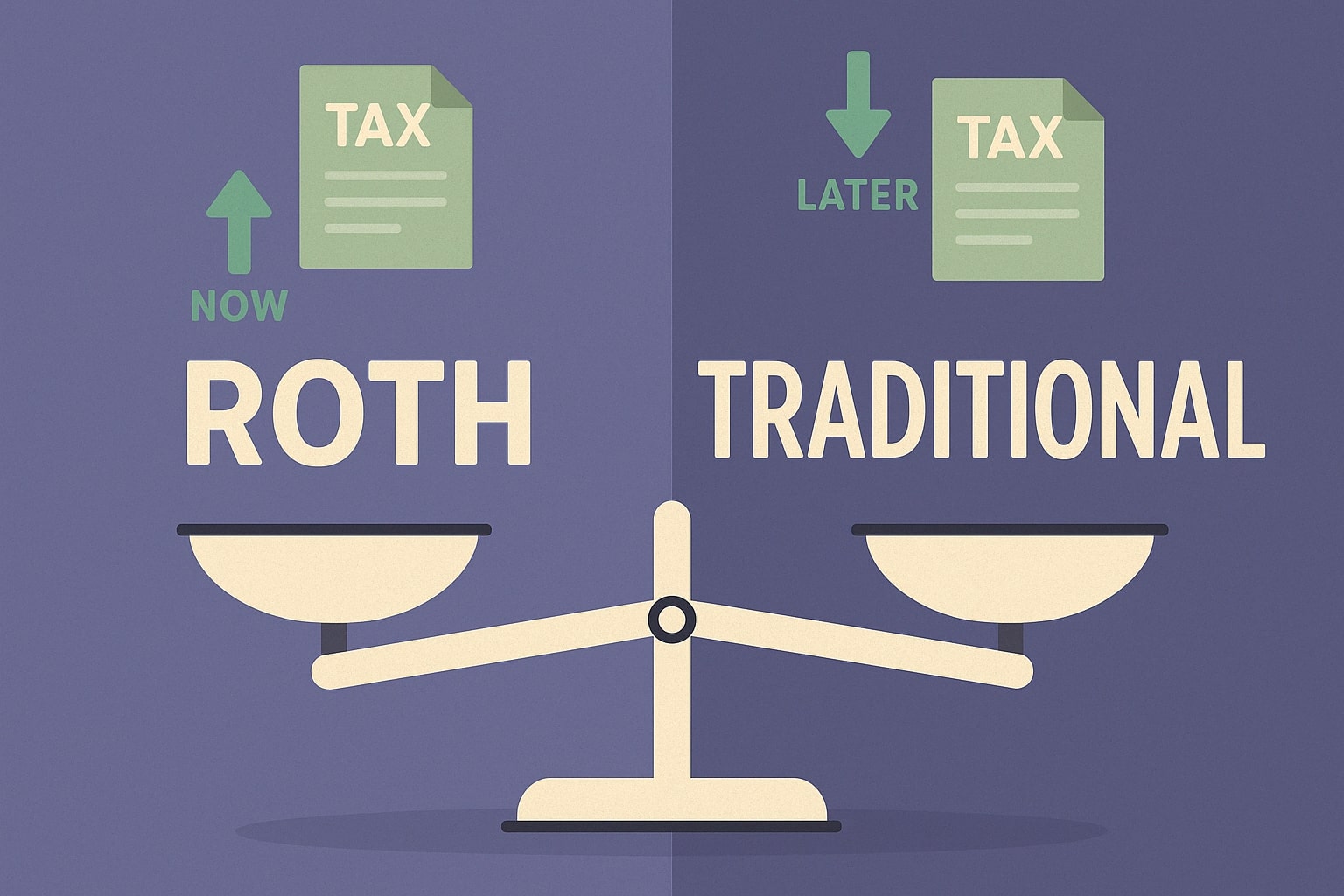

The Big Question: Pay Taxes Now or Later?

This is the core difference between Roth and Traditional:

- Traditional: Pay taxes LATER.

- Roth: Pay taxes NOW.

Let's unpack that.

Traditional Accounts (IRA & 401(k))

- Contributions: Made with pre-tax dollars. This means your contribution might be tax-deductible in the year you make it, potentially lowering your current taxable income.

- Growth: Your investments grow tax-deferred. You don't pay taxes on investment gains or dividends each year.

- Withdrawals: Money withdrawn in retirement is taxed as regular income.

Who it might be good for: People who expect to be in a lower tax bracket in retirement than they are currently, or those who really want or need the tax deduction now.

Roth Accounts (IRA & 401(k))

- Contributions: Made with after-tax dollars. You don't get an upfront tax deduction.

- Growth: Your investments grow completely tax-free.

- Withdrawals: Qualified withdrawals in retirement (generally after age 59 ½ and the account has been open 5 years) are 100% TAX-FREE. Yes, completely tax-free income in retirement!

Who it might be good for: People who expect to be in a higher tax bracket in retirement than they are now. This often includes young professionals whose income is likely to grow significantly over their careers. The tax certainty in retirement is also very appealing. Roth IRAs also offer a bit more flexibility, allowing penalty-free withdrawal of contributions (not earnings) under certain conditions.

Contribution Limits for 2025

These limits apply to your total contributions across all accounts of that type:

- IRAs (Roth + Traditional combined): $7,000 if you are under age 50.

- 401(k)s, 403(b)s, TSP (Employee contributions, Roth + Traditional combined): $23,500 if you are under age 50.

Note: You can contribute to both an IRA and a 401(k) in the same year if you're eligible, up to their respective limits.

Important Income Limits (Especially for Roth IRA)

While anyone with earned income can contribute to a Traditional IRA (though the deductibility might be limited if you have a workplace plan), there are income limits for contributing directly to a Roth IRA.

- For 2025:

- Single filers: Must have a Modified Adjusted Gross Income (MAGI) below $150,000 for a full contribution (phases out up to $165,000).

- Married Filing Jointly: Must have a MAGI below $236,000 for a full contribution (phases out up to $246,000).

If your income is above these limits, you might still be able to contribute via a "Backdoor Roth IRA" (a more advanced strategy).

How to Choose in Your 20s & 30s?

The key factor is your expected future income and tax rate.

- Likely Higher Income Later? If you're early in your career and anticipate earning significantly more (and potentially being in a higher tax bracket) down the road, the Roth option is often very compelling. Paying taxes now while your rate is relatively low allows for tax-free withdrawals later when your rate might be higher.

- Need the Tax Break Now? If you're in a surprisingly high tax bracket now or really value the immediate tax deduction, Traditional might be considered.

- Unsure? Consider Tax Diversification: Some people choose to contribute to both Roth and Traditional accounts (e.g., Roth IRA and Traditional 401(k)) to hedge their bets against future tax rate changes.

- ALWAYS Get the Employer Match: If your employer offers a 401(k) match, contribute at least enough to capture the full match before contributing elsewhere. It's free money! (Note: Employer matching contributions typically go into a Traditional 401(k) account, even if your contributions are Roth).

Start Somewhere!

Don't let analysis paralysis stop you. Choosing Roth vs. Traditional is important, but the most important thing is to start saving consistently for retirement as early as possible. Pick the one that seems best for you now, get that employer match, and start building your future!

Disclaimer:

The information provided in this article is for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. The content is based on sources believed to be reliable, but the author and publisher make no representations or warranties as to its accuracy, completeness, or timeliness.

The author is not a licensed financial advisor, registered investment adviser, or broker-dealer. You should consult with qualified professionals (such as a Certified Financial Planner®, accountant, or attorney) who can assess your individual situation before making any financial decisions or taking any action based on the information presented here.

Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Any examples or discussions of specific investments, strategies, or products are for illustrative purposes only and are not endorsements or recommendations.

Financial markets and regulations change frequently, and the information in this article may become outdated. We are not obligated to update any information herein. Your financial situation is unique, and any decisions you make should be based on your own research, due diligence, and consultation with professional advisors, considering your personal objectives, risk tolerance, and financial circumstances. Reliance on any information provided in this article is solely at your own risk.

Stay Ahead with Our Newsletter

Get exclusive financial insights, market analysis, and expert tips delivered directly to your inbox.